The day after my house burnt down, my family went to the mall smelling like the smoke that had poured into our home. We had a place to stay the night before but no towels or soap or toothbrushes or any of the household items that piece together an average day in America.

I’m pretty sure I was in flip-flops despite it being cold, and I’m definitely sure my 11-year-old self chose to buy pinstripe slacks from Rue21 as her first article of replacement clothing.

Things were weird. But we stepped closer to normalcy every passing moment with the help of family, friends, and complete strangers from our neighborhood.

From giving your old clothes or just giving your time, there are many ways to help someone who has lost their home in a fire. I hope you will never need this advice, but if you someday do, here are 25 tips from me, a home insurance expert, a lawyer, and the smartest person on planet Earth (my mom, Martina Fox). Plus, for the future, we outline a quick and easy guide to renter's insurance

1. Immediately get emergency essentials — toiletries, a set of clothes or at least underwear, a phone charger — to them within hours of the fire. My mom says this will help people feel less frazzled, as “you just need everything. You are just overwhelmed.”

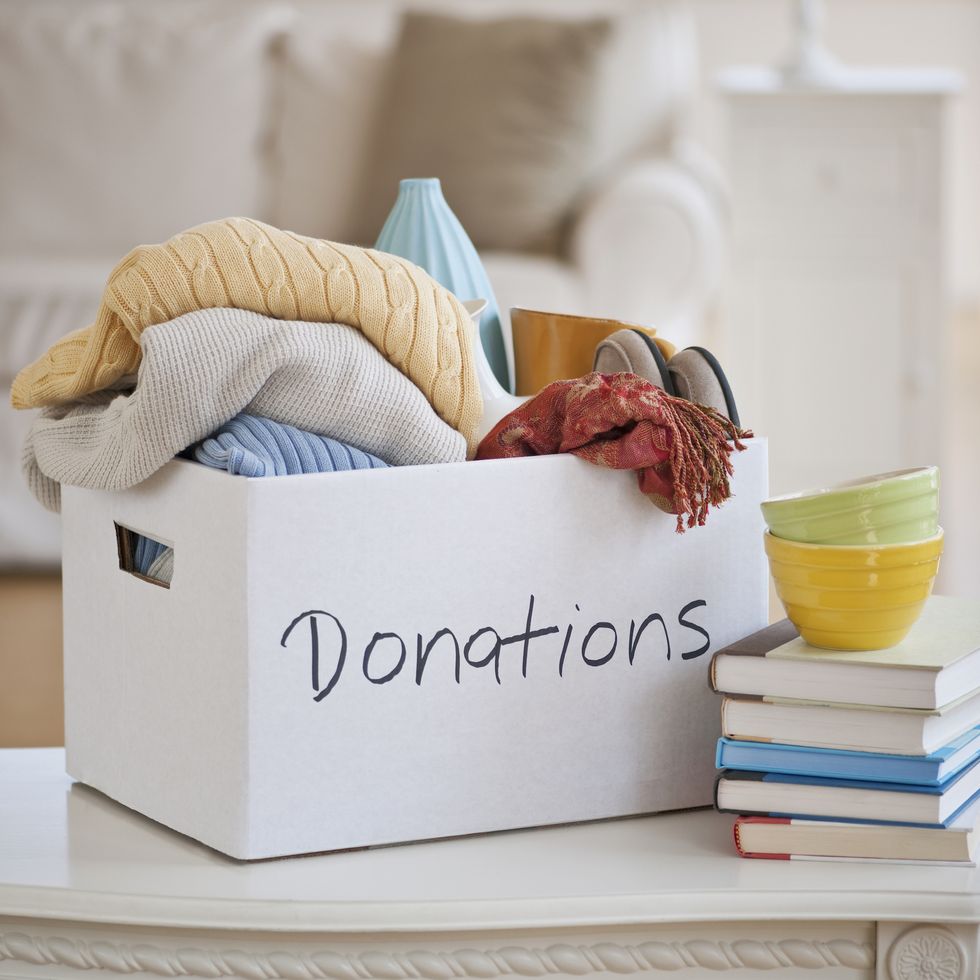

2. Give them bags of your old clothes and buy them so many pairs of socks and underwear. Even if they have access to a washer and dryer, laundry won’t be at the top of their to-do list.

3. Immediately offer or help them find a place to stay. “The last thing someone wants to worry about when they are standing out on the street is where they will sleep that night,” says attorney and author Marc Wites, who has handled lawsuits related to house fires.

4. Buy them organizing journals and binders to store their receipts and paperwork for the insurance claim.

5. Offer to clean wherever they are staying.

6. Offer to go with them to the site of the house fire. My mom’s friends went with her to search through the rubble a couple days later to see if anything was salvageable.

7. Give them physical items instead of only donating cash or gift cards. “Cash didn’t help as much as the others thing because if you have insurance policy you ultimately get the cash, but you need time and work and help,” my mom said.

8. Offer to run errands for them.

9. Give them a spice rack, tupperware, flashlights — literally any housewares gifts that would save them the trouble of having to go buy it themselves when they are already so busy piecing things back together.

10. Make them a picture album of any photos you have of them, their home, and their family members.

11. Reach out to their or their children’s high schools and see if there are extra copies of old yearbooks available.

12. If they have a pet, give them a crate and essentials, such as leashes and pet food.

13. Volunteer to take in their pets while they get back on their feet.

14. If you were a regular visitor to their house, both my mom and Christopher Hackett, a senior director at the Property Casualty Insurers Association of America, say you can help them as they make an inventory of the personal possessions they lost to give to the insurance company.

15. Volunteer to babysit.

16. Invite them over for a home-cooked meal — especially if the family is holed up in a hotel. "Folks may be a little stir-crazy if they are contained in a small space like that,” Hackett says. “It may be good for the kids to have the opportunity to be at normal home environment every so often.”

17. Wites suggests always having a backup of your inventories and legal papers stored offsite of your home. It’s too late after the point of a house fire, but you can offer to hold onto a loved one's copies of certificates and legal papers in the future.

18. Get toys to the kids quickly “to reassure them things that are going to be OK and help them feel more comfortable,” says Hackett.

19. Particularly in a situation like the California wildfires in 2017 where wide-spread blazes are impacting multiple communities, Hackett recommends connecting them to support groups, church communities or even Facebook groups focused on handling the aftermath.

20. As holidays approach, my mom recommends giving them decorations. Her friend gave her sparkly pumpkins that fall, and now every year the number of sparkly pumpkins my mom still puts out seems to quadruple.

21. It takes a long time for things to return to normal after a fire. My father talks about how, for years after, going to reach for items and then remembering they don’t exist anymore. As the seasons pass, Hackett recommends just “regularly checking in on them and just calling and letting them know that you’re there for them.”

22. And when the time comes, help them pick out new furniture for the new house.

23. If you’re a family member and you have family trees, photos of ancestors, or heirlooms that you can duplicate or are willing to part with, these gifts will help the displaced person still feel connected to their roots.

24. If you don’t have the means to do anything else, write them out a letter or a card. It’s always a good idea to do anything “to remind them that they are being thought of and are cared about,” Hackett says.

25. A final piece of wisdom from my mom: “Money is not as important as the other things. The time and friendships — that was most important."

Renter's Insurance 101

What Is It?

Renter’s insurance is a basic insurance policy that covers you and your belongings when you live in a home that you lease from a landlord. It’s designed to protect your property in any number of unpleasant situations, from burglary to a burst pipe, and might also help protect you if your landlord is less-than-scrupulous when it comes to repairs and building safety.

What Does It Cover?

Typically, renter’s insurance covers three areas: reimbursement for damaged property, liability, and incurred expenses for uninhabitable space. The extent of coverage varies by policy.

- Reimbursement for damaged property: If your laptop gets stolen by a burglar, or a fire torches your couch, your insurance policy should cover at least part of the cost of replacing or repairing your stuff. If you have lots of valuables, you’ll want to pay for a more extensive policy.

- Liability: This protects you in case a visitor is ever injured in your home, and you’re found to be at fault. Say a handyman slips on water in your kitchen and sprains his ankle; he can likely file a claim with your insurance company to get compensation for medical care or time off work.

- Incurred Expenses: This coverage helps you out if your rental becomes uninhabitable due to landlord negligence, or a so-called ‘act of God’ like smoke or storm damage. This coverage will help you out by covering at least part of the cost of a hotel room or other alternative living arrangement.

Who Needs Renter’s Insurance?

If you live in a rental home or rental unit, you need renter’s insurance. Landlords might even require you to get it when you sign the lease. Even if you think that the chances are slim you’ll ever need it, you’d be surprised how often you need to expect the unexpected.

How Much Does It Cost?

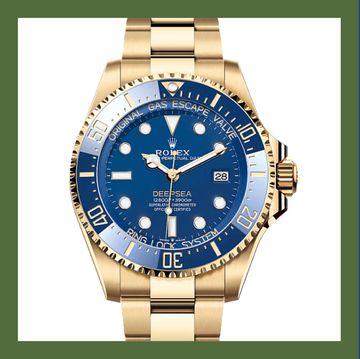

Typically, renter’s insurance is pretty reasonable. You’ll need to plug your address into a quote calculator to get a precise estimate for your region, but according to Forbes, renter’s insurance costs about $20 a month on average across America. Your price point might be higher if you have a lot of valuable jewelry or electronics that you want to protect. At the end of the day, it’s worth the peace of mind, and might save you thousands in lost property down the road.